By Eric Dresselhuys, CEO

On Friday, Federal Reserve officials signaled a likely July interest rate increase of between 0.75 and 1%, following June’s increase of 0.75%, in an effort to cool inflation which hit 9.1% in June.

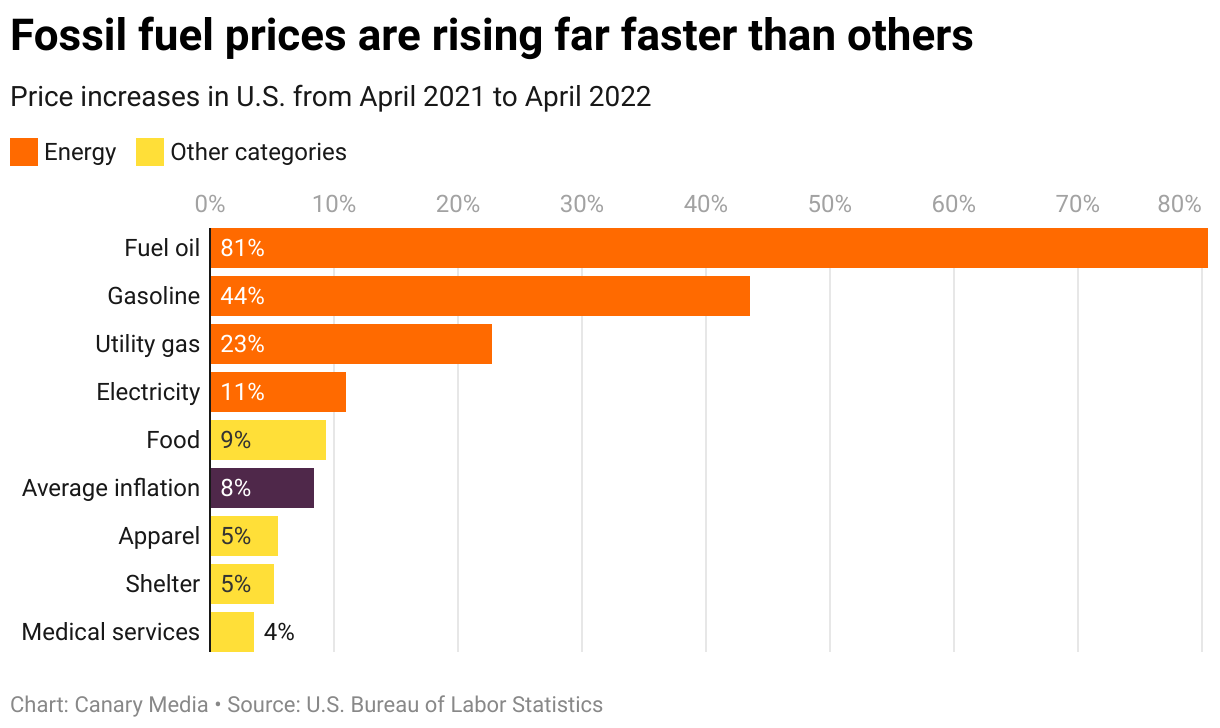

Today’s inflationary cycle results from a combination of circumstances, but instability in global energy markets is the fundamental driver of today’s economic challenges. The past two years have illustrated the inherent volatility of our current energy economy. In April of 2020, the price of a barrel of West Texas Intermediate crude collapsed, dropping below $0 for the first time as demand evaporated due to early Covid-19 lockdowns. Oil markets have always experienced boom and bust cycles, but this time, oil producers have been slower to expand production capacity than following previous downturns, even as the broader economy recovered at a rapid pace.

While the Federal Reserve’s actions are likely to cool inflation, they do not address the underlying vulnerabilities of an economy reliant upon fossil fuels. Fortunately, today, there are real alternatives to the status quo which can deliver low-cost, inflation-resilient clean energy.

Unlike oil, wind and solar energy have declined in cost steadily and substantially since 2009 and are now the lowest cost alternatives for new generation capacity. Low costs are a positive, but an often-overlooked additional benefit is the relative price stability that renewable projects deliver.

The reason is simple: Renewable project cost structures are fundamentally different than their fossil fuel counterparts. Wind, solar and storage projects require significant initial capital expenditures, but then cost very little to operate given that the fuel is free and maintenance requirements are minimal. Once a renewable project achieves commercial operation, the cost of energy generated by that project is largely stable, regardless of broader economic trends.

On a macro level, this means that as the proportion of renewables increases (and both transportation and buildings are increasingly electrified), energy costs can be expected to stabilize. In a predominantly renewable energy economy, energy will shift from a driver of inflationary cycles to a bulwark against them.

The good news is that building an economically resilient energy future isn’t dependent upon hypothetical future breakthroughs. Wind and solar technologies are largely mature and new long-duration energy storage (LDES) technologies, such as the iron-flow batteries manufactured by ESS, are now commercially available. When paired with wind and solar, LDES technologies provide low-cost, long-duration energy storage that enables affordable, reliable, renewable energy to power our economy 24/7. McKinsey & Co. predicts that renewable generation plus LDES will deliver energy for under $100/MWh, cheaper than many other forms of baseload power.

We know how to create this inflation-resilient clean energy future. Policies incenting the first 30 years of wind and solar deployment delivered substantial growth, economies of scale and innovation. Building on these successes to drive continued renewable development with the addition of LDES will deliver the economically resilient energy system that we need.

Some have expressed concerns that investment now could drive further inflation. This misses the fact that, despite the risks they pose to the economy, fossil fuels still receive extraordinary subsidies, totaling $5.9 trillion in 2020. Creating a level playing field with investments and incentives for clean energy and energy storage will not only help us move through the current period of economic uncertainty but will create an energy system more resistant to the next.

Links to third-party articles and/or websites are for general information purposes only and the content of any third-party article or website is solely the responsibility of the author, owner, operator or publisher of that article and/or website. Views expressed in third-party articles and/or websites reflect the opinion of the author, owner, operator or publisher as of the date of publication, and not necessarily those of ESS Tech, Inc. ESS Tech, Inc. has not independently verified such content, makes no warranties, representations or undertakings relating to such content, and bears no responsibility for the accuracy, legality or content of any external site or for that of subsequent links. Any reliance you place on such information is strictly at your own risk. You are encouraged to read and evaluate the privacy and security policies on the specific site you are entering. ESS Tech, Inc. disclaims any loss, damage and any other consequences resulting directly or indirectly from or relating to your access to the third-party website or any information you may provide or any transaction conducted on or via the third-party website or the failure of any information, goods or services posted or offered at the third-party website or any error, omission or misrepresentation on the third-party website or any computer virus arising from or system failure associated with the third-party website.