By Hugh McDermott, SVP Sales & Business Development

Today, electricity supply and demand must be perfectly balanced on the grid to ensure that the lights stay on and the system remains stable. Wholesale electricity markets have been implemented in many regions to support this balance by creating financial incentives and competition among energy generators and wholesale purchasers to match supply and demand.

However, periods of “negative pricing” are becoming an increasingly common phenomenon in electricity markets and can pose real challenges to generators’ and transmission operators’ bottom lines. When there is too much supply but not enough demand in a given region, the Location Marginal Prices (LMP), which refers to market pricing at given transaction points (or “nodes”) on the grid, become negative. This creates financial challenges to generators and transmission operators as it means they effectively have to pay customers to take their power.

This negative pricing phenomenon is driven by two principal factors:

- Increased renewable generation capacity, which relies upon fuel that is free when available, can drive LMP in a given region negative by generating more energy than is needed, particularly on very sunny or windy days. Without anywhere for excess clean energy generation to go, these resources are typically curtailed, which wastes clean energy, cuts revenues for generators, and increases carbon emissions.

- Transmission congestion can also lead to negative pricing. Transmission lines are essentially tolled highways for electricity. When lines are congested, the toll increases. This can drive LMP into negative territory for generators wishing to transmit the electricity they generate across a congested transmission line.

Fortunately, new long-duration energy storage (LDES) technologies can address both challenges and allow generators and transmission operators to benefit from variations in LMP to maximize revenue while supporting a balanced grid. By storing excess energy during periods of renewable over-supply or transmission congestion, LDES takes advantage of abundant cheap power and makes it available for sale into the market when LMP is favorable.

Frequency of negative Location Marginal Pricing in 2017. Source: LBNL

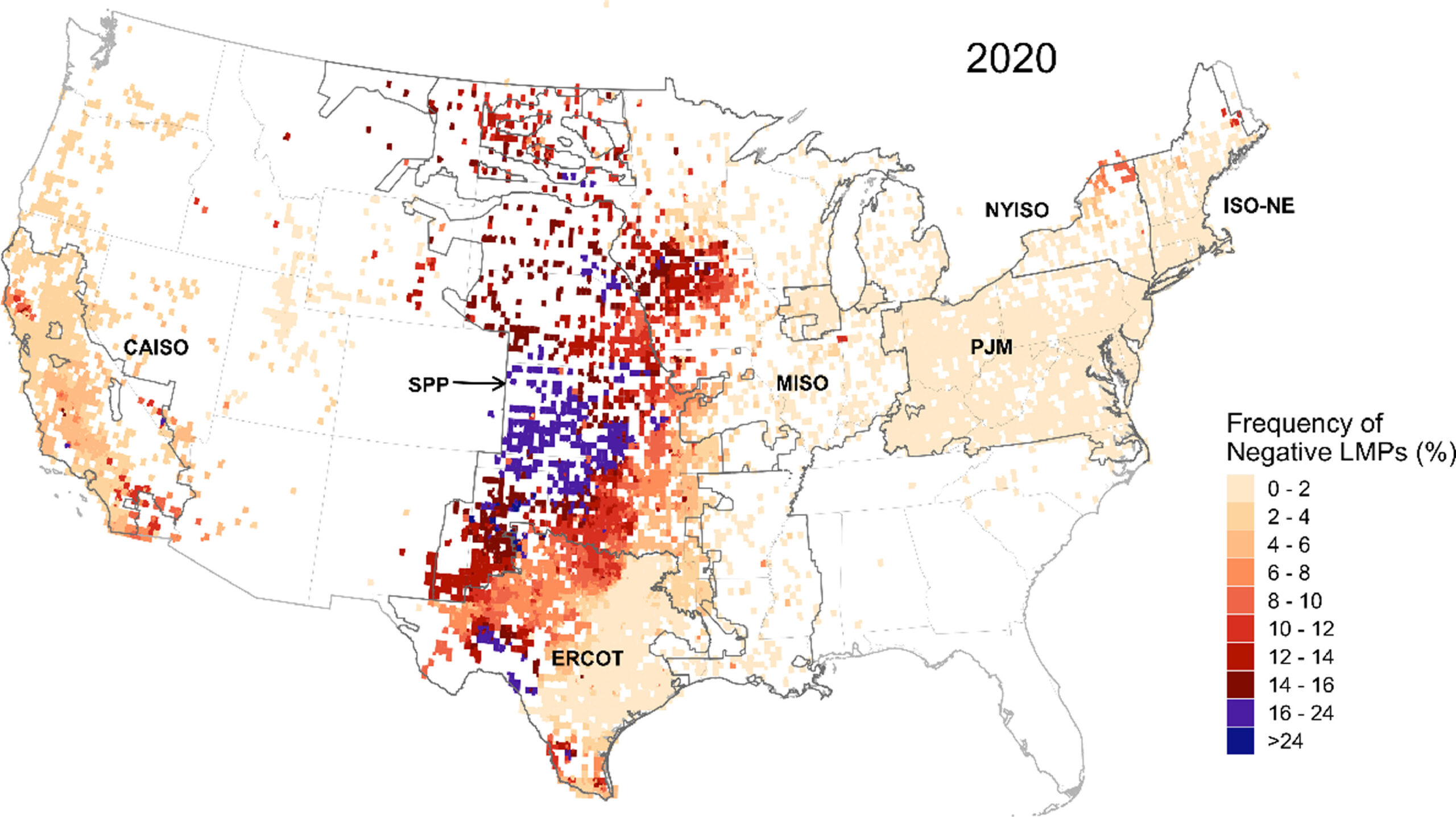

According to research from Lawrence Berkeley National Laboratory (LBNL), the U.S. experienced negative pricing 4 percent of the time in 2020. However, these periods of negative pricing are not evenly distributed nationwide. In certain regions, negative pricing is more prevalent due to transmission constraints or significant regional deployment of intermittent renewable generation capacity.

For example, in some parts of Kansas, Oklahoma and Texas, nodes experience negative pricing over 25% of the year, driven by a combination of abundant, though intermittent, wind generation capacity and limited transmission infrastructure.

In California, the frequency of negative prices is increasing as well. During the last quarter of 2021, incidences of negative pricing increased by 70% over the 2020 levels. This correlated to a renewable production increase of 9 percent according to the California ISO.

In those regions with consistently negative nodal pricing, the financial opportunities to implement storage for congestion mitigation are real. In the last quarter of 2021, congestion pricing in the California day-ahead market increased by approximately 50 percent over 2020, from $103 million to $155 million, according to the California ISO. These reflect direct costs to generators and ultimately, energy consumers, which could be mitigated with the addition of LDES to maximize efficiency and asset utilization.

Long-duration energy storage will be a key part of the clean energy future, and new technologies offer opportunities to meet different needs. ESS iron flow battery technology allows generators and transmission operators to fully realize the opportunities presented. ESS technology’s unlimited cyclability, rapid response time and durations from 6-12 hours provide the flexibility needed for generators and transmission operators to capitalize on market opportunities. As a leading long-duration energy storage provider, ESS is pleased to do its part to stabilize energy markets and to build partnerships with power generators to ensure a reliable energy supply.