Today’s energy grid was built to transmit power from large, centralized generating stations (usually powered by coal or nuclear) to distant load centers. The dynamics of the grid are evolving rapidly as more intermittent renewable electricity is added, creating economic and operational challenges and opportunities across the system.

Renewable energy intermittency isn’t only a challenge on a cloudy day, when there may not be enough solar energy to meet demand. The opposite problem – too much renewable generation — creates challenges as well. In sunny California, over 2.7 TWh of renewable energy (mostly solar) were curtailed last year, and in the windy Midwest, periods of excess wind generation now lead to electricity prices on the grid routinely entering negative territory.

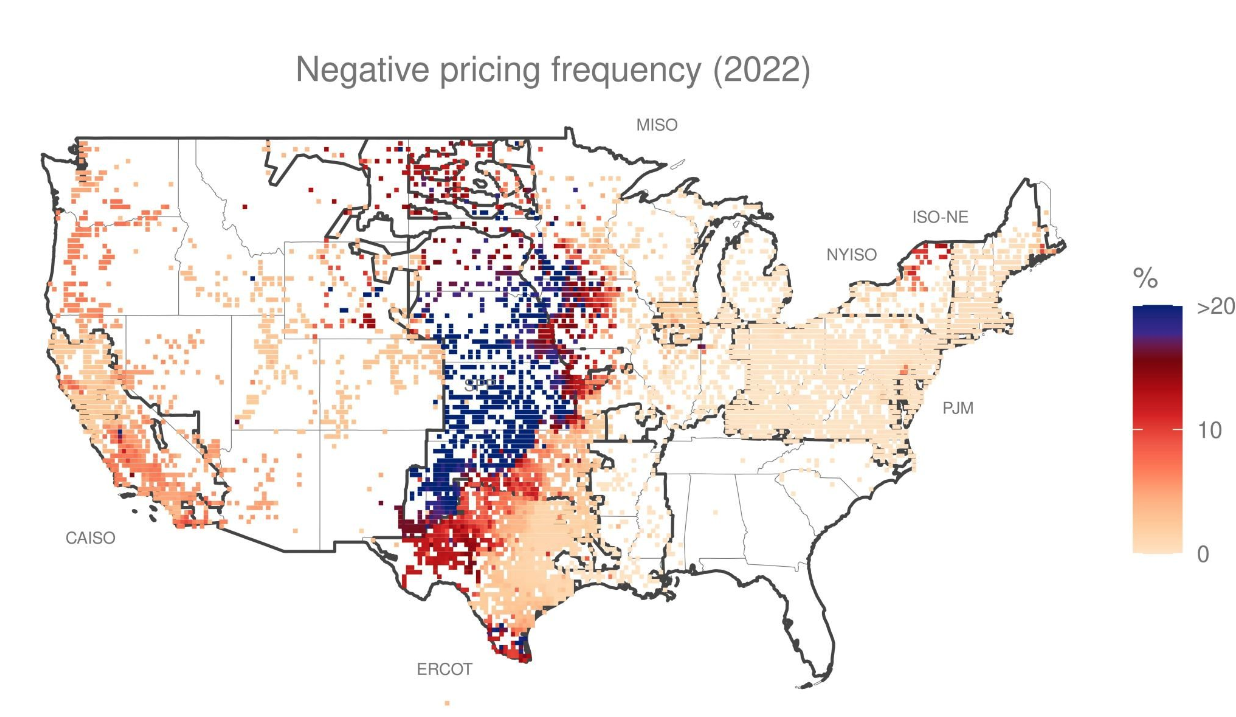

Negative Location Marginal Pricing (LMP) is caused by grid congestion and creates challenges for utilities, transmission operators, and power producers. This problem is well documented by leading analysts from the Lawrence Berkeley National Lab, among others, who have shown that negative LMP is now a widespread reality at numerous points on the grid for significant portions of the year.

Negative Location Marginal Pricing (LMP) is caused by grid congestion and creates challenges for utilities, transmission operators, and power producers. This problem is well documented by leading analysts from the Lawrence Berkeley National Lab, among others, who have shown that negative LMP is now a widespread reality at numerous points on the grid for significant portions of the year.

In a May presentation to the New York Battery and Energy Storage Technology Consortium, Wood Mackenzie forecasted increasing negative pricing instances through 2040. They not only predict that negative pricing will worsen in areas it already exists today but will also expand to new energy markets like the American Northeast.

However, the growing number of locations with pervasive negative LMP represent a tremendous opportunity for long-duration energy storage (LDES) with storage durations of eight or more hours.

Technologies such as ESS’ iron flow batteries provide an opportunity to improve renewable utilization and grid operation while delivering favorable returns for asset owners. Due to their inherent capabilities, iron flow batteries offer more operational and market flexibility than lithium-ion energy storage, enabling operators to leverage multiple revenue streams and to flexibly adapt as the future markets evolve. We explore this in our recent whitepaper, “The Opportunity in Oversupply: Deploying Long-Duration Energy Storage to Capitalize on Negative Pricing.”

Unlimited cycling unlocks multiple revenue streams

Unlike lithium-ion systems, iron flow technology provides unlimited cycling ability with zero capacity degradation over a project’s lifetime. While lithium-ion systems can cycle once per day, iron flow systems can cycle continuously, increasing revenue opportunities.

Iron flow systems allow owners to leverage multiple revenue streams to capitalize on negative pricing while still meeting local market and grid needs. With anticipated fast charging capabilities, iron flow systems could maximize the use of negatively priced energy to generate revenue from day ahead and real time market arbitrage while also serving capacity markets. Serving multiple markets at once is how iron flow batteries make an economical, resilient renewable energy system possible.

ESS Iron Flow Technology Offers Attractive Returns

In this paper, ESS modeled the internal rate of return (IRR) for a stationary 50 MW / 400 MWh 8-hour storage project, hypothetically located at a node in the New York ISO which experiences frequent negative pricing. The model results compare the expected IRR of equivalent lithium-ion and iron flow battery projects across three scenarios, incorporating various assumptions about merchant and capacity operation on an annual basis.

The results are clear – iron flow technology can deliver very attractive returns in regions. Learn how iron flow batteries can offer attractive returns in “The Opportunity in Oversupply: Deploying Long-Duration Energy Storage to Capitalize on Negative Pricing” white paper. Then, contact us to discuss how iron flow technology can benefit your clean energy portfolio.