Why Long-Duration Energy Storage

LDES is the linchpin of the energy transition

Building a clean, resilient and secure energy system will require significant energy storage to meet growing demand from AI data centers and enable intermittent sources of energy to provide baseload power. This is projected to include up to 8 TW of LDES by 2040. When the sun sets and the wind dies down, LDES will keep the lights on.

New energy technologies need to be safe, sustainable, flexible, and cost-effective. ESS Tech, Inc.’s (ESS’) iron flow technology is best positioned to meet those needs.

ESS is the LDES market maker

ESS is an established player in the rapidly growing LDES market. Our field-proven technology was developed, tested, validated, and commercialized in the United States and is delivered worldwide, supporting American energy dominance.

ESS technology has been selected by leading U.S. and global utilities who are pioneering the clean energy transition by deploying advanced LDES technology today.

Our iron flow technology has hundreds of patents pending or awarded and has been validated by third parties including the U.S. Department of Energy and global insurance leader Munich Re. In 2023, Honeywell invested in ESS and entered into a joint development agreement to drive the further development and deployment of iron flow batteries.

We maximize value with flexible storage solutions

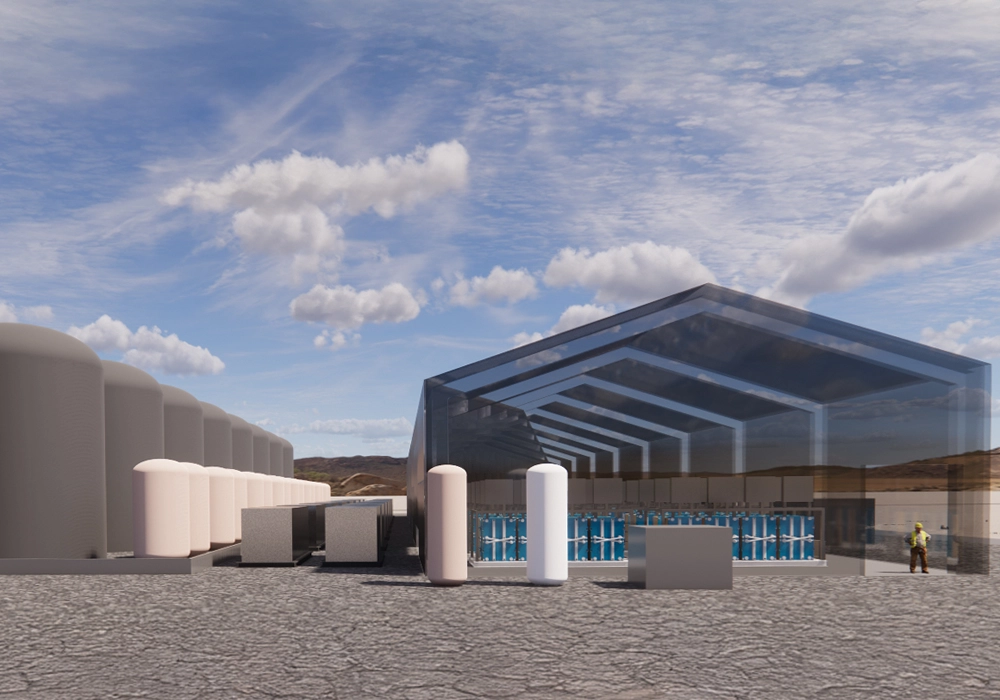

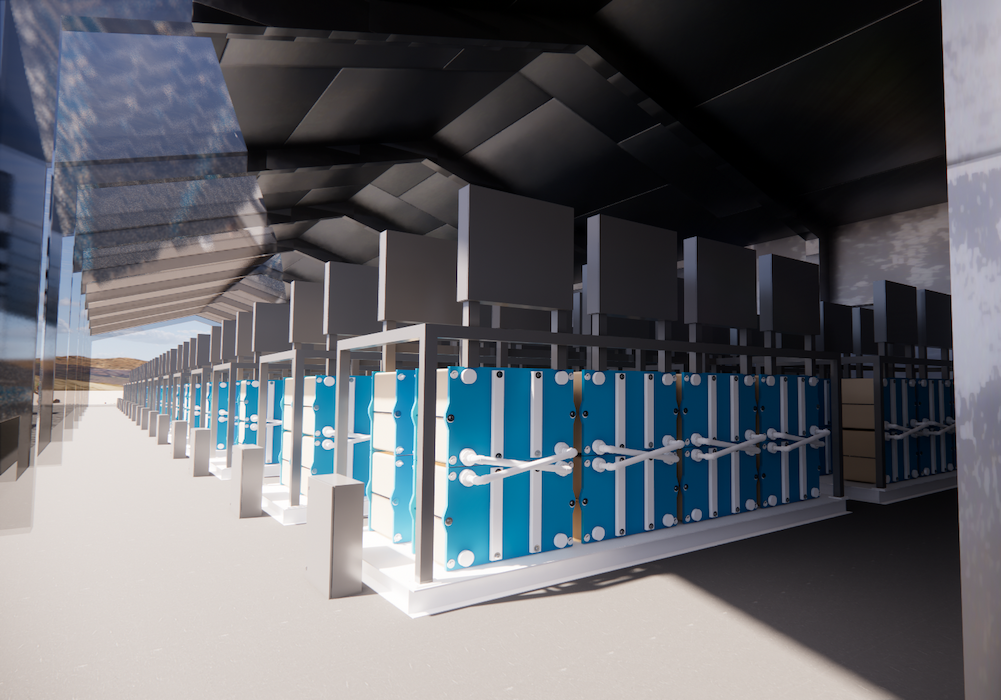

Iron flow technology delivers unlimited cycling with zero capacity degradation over a 25-year design life. This means our solutions can be charged and discharged multiple times each day, allowing our customers to serve multiple use cases with the same asset, optimizing the value of excess energy. Let us show you how to maximize the benefits and unique characteristics of our iron-flow battery storage solutions, the Energy Base™ (EB), Energy Warehouse® (EW), and the Energy Center™ (EC).

The ESS cost and performance advantage

The economic opportunity for many projects is enhanced when additional cycles become possible. ESS systems deliver superior value over a 25-year project life due to lack of capacity degradation, longer asset life and unlimited cycling.

Unlimited cycling with no impact on 25-year design life.

Safe for deployment in urban areas or harsh and pristine environments.

ESS wins on sustainability

Any energy technology should make environmental and economic sense. ESS storage solutions are sustainable to source, build, and operate, minimizing supply chain risk and climate impact.

Secure supply chain of domestically available materials.